Actions by Federal Reserve, European Central Bank and Bank of Japan during the last few weeks have brought the liquidity in the markets. After a prolonged policy paralysis, Government of India too finally took important and tough decisions to hike the diesel price and reduce the subsidy burden on cooking gas. Immediately after this, FDI in retail, airlines, broadcasting and insurance was announced. All these decisions have led to a boost in investor confidence. With FIIs pumping money in the Indian stock markets, the sensex has rallied from the range of 17000 – 18000 to 19000 levels. This has happened so fast that the investors sitting on the fence were taken by surprise.

First rule of investing in the stock market is to buy low and sell high. It is very difficult to identify what can be called low and high. Also, many investors believe in timing the market. Best of the Fund Managers have not been able to time the market. This results in retail investors usually entering the market when it has already moved up.

It is advised that one should never enter stock markets with a short term horizon. If one takes the risk of investing money in equities for short term duration, it is a sure way of heading for a financial disaster. Investing is not a short cut to wealth creation. You need to treat it like any other work. Investing in stock markets can help you grow rich slowly.

Stock markets historically have given a compounded annualized return of 15 to 18%. In my opinion, there is no other asset class which can give you such high returns. Rs. 1000 invested in 1980 is worth more than Rs. 1.70 Lakhs today. During this period there have been bull and bear phases in the market. Sensex was at 1908 in 1991 and is currently around 19000.

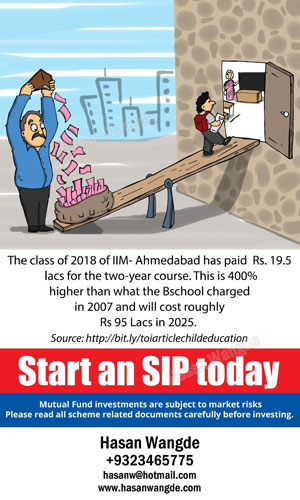

It is important to do a research and then decide to buy the stocks Remember you are buying the companies and not the markets. It is important to choose a company with good business, reasonable valuations and of course good management with an eye for growth in future. If you do not have the time or inclination to do a research, it is better to invest through mutual fund by registering yourself in a systematic investment plan popularly known as SIP.

Now that the Government has decided to come out of hibernation, it is expected that it will re-focus on the development of infrastructure in the country. Also in order to keep the cost of borrowing low, RBI may reduce the interest rates. Therefore, now is the time to look at those stocks which have been laggards and are available at cheap valuations. Investors with low risk appetite should look at large companies only preferably the top 100 or top 200 companies. You can check the list of companies listed under BSE-200.

If you believe in delayed gratification and prosperity in the long term, it is always a good time to start investing for a profitable future.