Ravi worked in the same organisation for a decade. He wanted stability in his life. He wanted to be in control of himself and of things around him. He did not wish to keep changing his job. He wanted stability in his life.

However, in that one decade of his working for the organisation, his CEO changed thrice.

Each time the CEO changed, some of his peers also changed, the culture of the organisation also changed.

In essence while he firmly stood his ground the environment around him changed and he just couldn’t do anything to prevent it.

Thus in a sense he worked for three different organisations in that one decade although he never ever resigned and changed his job.

Try as hard as we may, we cannot control change. If we don’t change the world around us will. In either case the only survival strategy is to learn the art of adaptability.

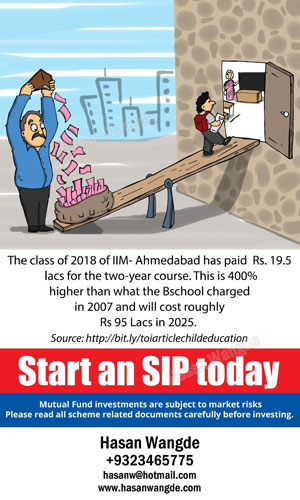

Likewise in personal finance too, many investors seek stability. They shun change. Who wants to rock the Apple cart? If everything seems so stable then why should I learn new things?Who knows what will happen if I try something new?

Fixed deposits were great products many years ago that provided stability and good returns. But over time, the returns have fallen considerably even though they are stable.

Still most investors of Fixed Deposits did not change even as returns changed.

New investing opportunities like equity investing appeared but the love for stability, control and guarantee prevented adaptability and adoptability.

While stability in the short term was still a possibility with FDs but it no longer provided long term stability because their low returns meant that very little wealth got formed in the long term which actually made the future more unstable.

People do not realise that it is “returns” and not “the lack of volatility” that makes the long term future stable.

Since the environment and surroundings change even if we stay put and stick to our grounds, it means we cannot stop change and our only strategy of survival is our ability to adapt ourselves by learning about new investing strategies.

In this context it is essential and very crucial to learn about equity products, to learn about the markets, to learn about the real and perceived risk etc. But come what may we have to learn, adapt and adopt.

Please contact your Financial Advisor immediately and get educated in personal finance. It is an urgent requirement because in investing “time” is the single most crucial ingredient. Lose time and you’re sure to lost future stability.

Stay Healthy, Be wealthy and a Wise Investor.

Financial Planning Ensures Efficient Management of Your Money.

Hasan Wangde

www.hasanwangde.com

cell: 9323465775